Helping Small Business Owners

Get Their Life Back!

Fractional Executive Solutions provides the experience and knowledge of a high powered operations professional for a fraction of the cost!

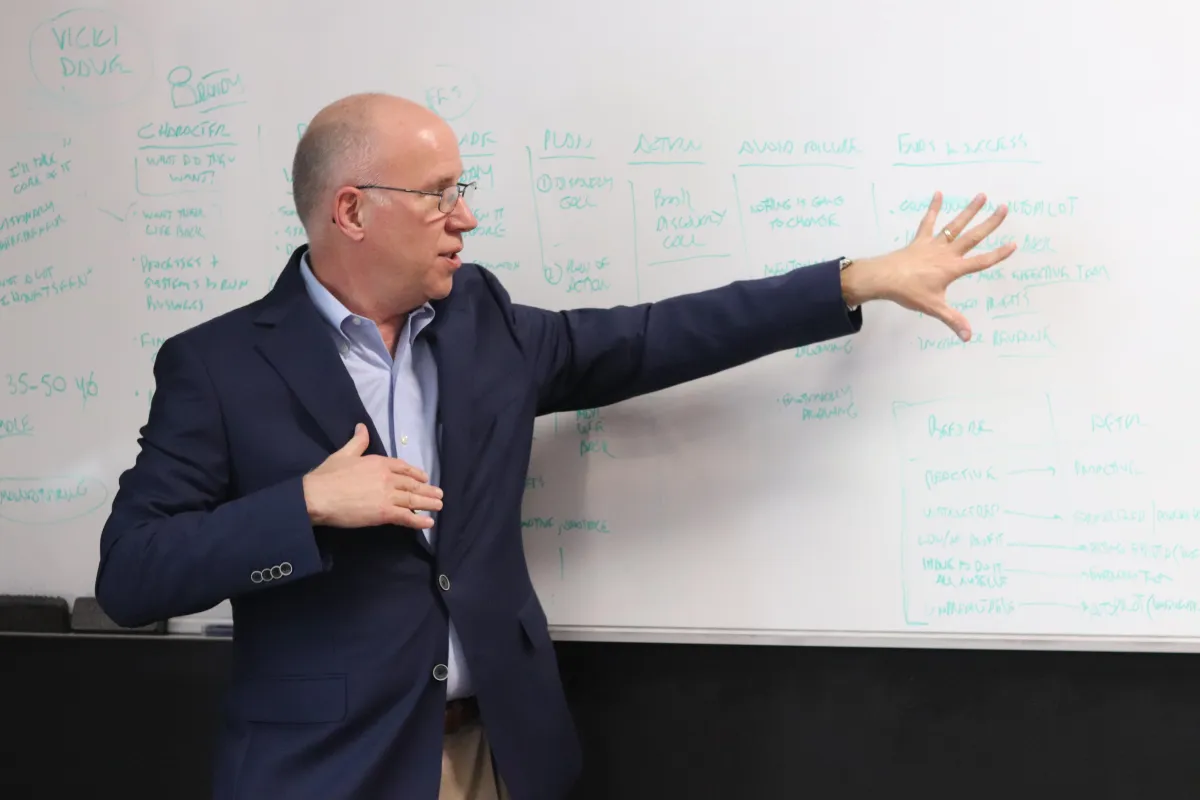

Meet David Baughman

"I help you get your life back"!

That’s not just a tagline—it’s the core of what I do for business owners who are stretched too thin, overwhelmed by the day-to-day, and buried in the constant demands of running their company. As a career operations executive with a proven track record of leading turnarounds across public and private companies, I specialize in bringing order to operational chaos.

I’ve seen it all—broken systems, overloaded teams, and processes that just don’t scale. And more often than not, the problem isn’t the people—it’s the lack of structure. I know what it’s like to wear every hat, and I know how exhausting that becomes as your business grows.

As a Fractional COO or Integrator, I bring clarity, structure, and hands-on leadership. What feels overwhelming to you is usually a “yep, I’ve got a system for that” moment for me. I work shoulder-to-shoulder with your team—coaching, mentoring, and building momentum—typically in just

one day per week.

From creating accountability to establishing operational rhythm, I bring

executive-level leadership at a fraction of the cost, so you can finally step back, focus on the big picture, and yes—make it to your kid’s ballgame or dance recital without your phone blowing up. Let’s rebuild your business so it works

for you—not the other way around.

WHAT I DO

Fractional COO

David is an accomplished Fractional COO who quickly evaluates and establishes an orderly process to ensure your operations run smoothly to allow you to do what you do best: grow your company. David provides leadership and guidance to your team to allow them to understand what it takes to provide “operational excellence” daily. With his extensive experience leading organizations across multiple markets, there are no operational challenges that David cannot help guide you and your team to accomplish your short- and long-term goals while developing and enhancing team health and execution.

Executive Coaching

There are numerous leadership coaches to choose from that work with CEOs and owners. At Fractional Executive Solutions, we offer leadership coaching for your team to ensure smooth delivery of your products or services to your customers as well as enhancing your bottom line. If you are an owner or CEO and you have an incumbent in the role of Manager, Director or even COO, we work with them exclusively to learn how to be a “pro,” while becoming a trusted advisor to you. We provide a structured and documented program that is created with your guidance and input to create goals, and skill sets to improve overall executive and leadership performance. Regular feedback is provided to you so you can see the development of your team as they start to leverage their newfound skills and help your your business thrive.

Emerging Leadership

There are numerous leadership coaches to choose from who work with CEOs and owners. At Fractional Executive Solutions, we offer Emerging Leadership Coaching for those who are about to embark on their first role as a manager or leader. For many, the first leadership role is hard because they must learn to be accountable for the performance of others as well as themselves while learning how to provide direction and guidance to a team. From learning how to manage through time constraints, difficult and often new challenges, or conducting “difficult” conversations, we help them learn the skills required to lead, manage, and hold others accountable. All in a structured process that includes a lesson plan and homework. Your new leader will appreciate the knowledge and the opportunity that they are provided to get a “head start” on their management career.

WHO I REPRESENT

WHAT CLIENTS SAY

EXPERTISE

How to create a manufacturing budget that saves you money

How to Build a Budget for a Manufacturing Company — and Turn It into a Productivity & Cost‑Savings Engine

Budgeting shouldn’t be a once-a-year spreadsheet marathon. Done right, it becomes a living roadmap that tightens cash control and sparks continuous improvement on the shop floor. Here’s a step-by-step playbook to help guide you and your team.

1. Start With a Zero‑Based Mindset

Instead of topping last year’s numbers by a token percentage, justify every line from scratch. Ask three questions of each member of your Leadership Team:

Does this expense directly create or protect revenue?

If we cut it by 30 %, what breaks? 15%?

What process change could deliver the same outcome for less?

Zero‑based thinking highlights “set‑and‑forget” spend (unused software seats, auto-renewed leases, bloated freight contracts) that quietly erode margins. Question every line item, no matter the size! Savings come from the small stuff as well as the large.

2. Build the Budget Around Your Value‑Stream Map

Traditional GL buckets (labor, materials, overhead) hide real productivity levers. Instead:

Map every step from quote to cash. A simple Process Flow Map will do.

Assign dollars—and KPIs—to each major value‑stream segment (Order Entry, Fabrication, Finishing, Shipping).

Roll the costs back up to the GL. What does it tell you?

When leadership sees high spend tied to a specific waste‑heavy loop (e.g., rework in Finishing), the budget itself points to the improvement target. By doing this, we can find opportunities that may not be obvious to us.

3. Anchor Every Cost Line to a Productivity Metric

For each department, pair one input metric (the spend) with one throughput or quality metric:

Area Budget Line Productivity KPI

Machining Direct labor $ Parts per labor‑hour

Maintenance Spare‑parts inventory $ Unplanned downtime hours

Fabrication Consumables $ Scrap % / first‑pass yield

Now every monthly variance meeting becomes a mini kaizen: “Labor is 7 % over—but if parts/hour is up 10 %, we’re still money ahead.” Look for trends and

4. Bake in “Targeted Kaizen Savings”

Some companies set an explicit CI savings line (e.g., “Kaizen Savings – $250 k”) right in the budget. Break it down by quarter and by team. Managers' finding that cash through 5S events, setup‑time reductions, layout tweaks, etc. It signals that improvement savings are expected—not a bonus—and keeps teams scanning for waste all year. This may not be practical or desirable, so you could build in savings in labor content as a percentage of revenue. Or how many labor hours will you need based on the revenue? Look at the ratio of the trailing 12 months for this item.

5. Couple the Budget with a Rolling 13‑Week Cash Forecast

Annual budgets can’t predict daily cash crunches. Maintain a living forecast that shows:

Weekly inflows and outflows (payroll, material buys, loan payments)

DSO and DPO goals with real-time updates

Scenario toggles for upside/downside demand shocks

This is a tool you should use every week, not just during budget season. But it helps here to understand the next few months and see if your assumptions will make sense or could they endanger your cash position.

6. Set Up a Monthly Budget Review Cadence

Daily: Cell‑level boards track hours vs. plan, scrap, OEE.

Weekly: Finance emails a one‑pager showing spend vs. YTD run‑rate and rolled‑up productivity KPIs. Review with your leadership team to ensure clarity about what we need to do to ensure budget attainment. Be rigid in holding each other accountable to the targets. Look for ways to EXCEED budget.

Monthly: 60-minute variance discussion—close the loop, assign owners, launch new CI projects.

Regular reviews keep the budget alive, not buried in a binder.

Quick‑Hit Checklist

☐ Zero‑base every line—no “last year + 3 %.”

☐ Tie dollars to each value‑stream segment.

☐ Pair every spend line with a throughput or quality KPI.

☐ Insert a quarterly Kaizen savings target.

☐ Run a rolling 13‑week cash model alongside the annual budget.

☐ Blend cost & productivity metrics in bonus plans.

☐ Review flash budgets daily/weekly; launch CI events from variances.

Bottom line: A great manufacturing budget is more than a financial control—it’s a continuous‑improvement roadmap. Make costs transparent, link them to real productivity metrics, and review them often. You’ll drive margin, free up cash, and build a culture that sees budgeting as a strategic weapon, not a necessary evil

GET IN TOUCH

Savannah, GA 31405 | (682) 514-9073

© 2026 Fractional Executive Solutions | All Rights Reserved