Helping Small Business Owners

Get Their Life Back!

Fractional Executive Solutions provides the experience and knowledge of a high powered operations professional for a fraction of the cost!

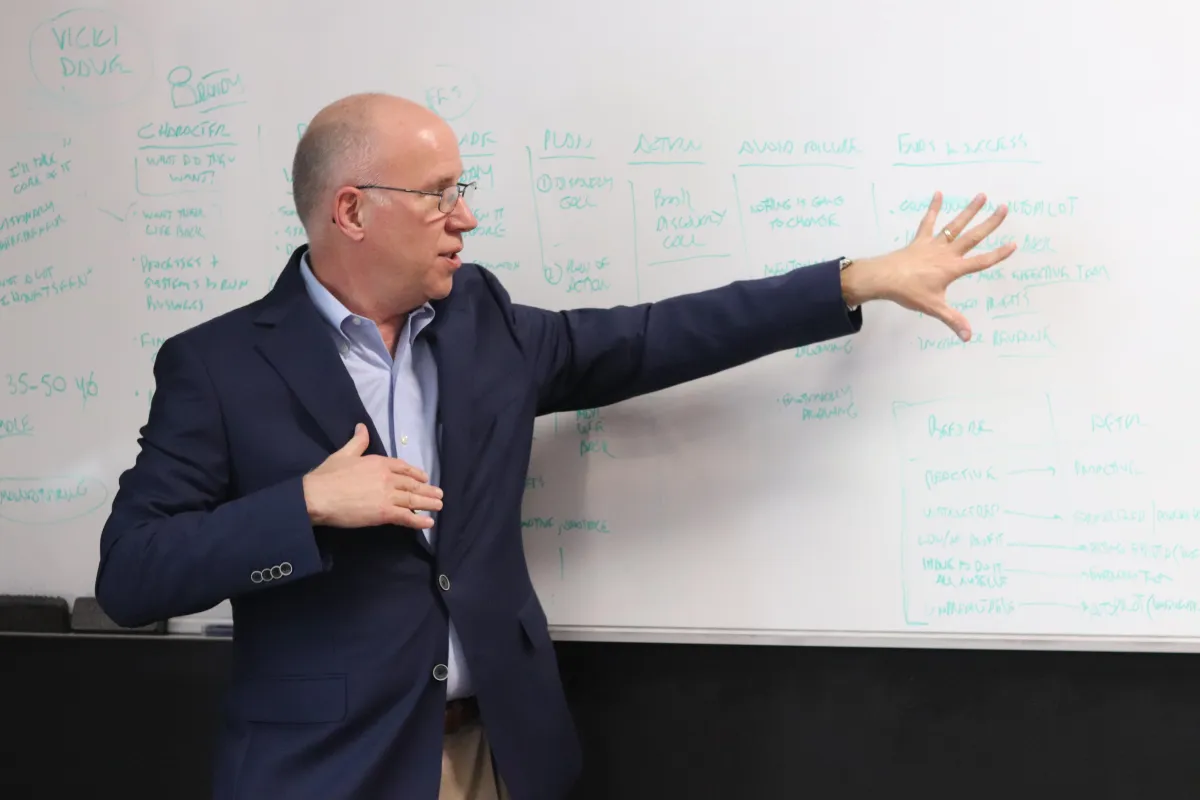

Meet David Baughman

"I help you get your life back"!

That’s not just a tagline—it’s the core of what I do for business owners who are stretched too thin, overwhelmed by the day-to-day, and buried in the constant demands of running their company. As a career operations executive with a proven track record of leading turnarounds across public and private companies, I specialize in bringing order to operational chaos.

I’ve seen it all—broken systems, overloaded teams, and processes that just don’t scale. And more often than not, the problem isn’t the people—it’s the lack of structure. I know what it’s like to wear every hat, and I know how exhausting that becomes as your business grows.

As a Fractional COO or Integrator, I bring clarity, structure, and hands-on leadership. What feels overwhelming to you is usually a “yep, I’ve got a system for that” moment for me. I work shoulder-to-shoulder with your team—coaching, mentoring, and building momentum—typically in just

one day per week.

From creating accountability to establishing operational rhythm, I bring

executive-level leadership at a fraction of the cost, so you can finally step back, focus on the big picture, and yes—make it to your kid’s ballgame or dance recital without your phone blowing up. Let’s rebuild your business so it works

for you—not the other way around.

WHAT I DO

Fractional COO

David is an accomplished Fractional COO who quickly evaluates and establishes an orderly process to ensure your operations run smoothly to allow you to do what you do best: grow your company. David provides leadership and guidance to your team to allow them to understand what it takes to provide “operational excellence” daily. With his extensive experience leading organizations across multiple markets, there are no operational challenges that David cannot help guide you and your team to accomplish your short- and long-term goals while developing and enhancing team health and execution.

Executive Coaching

There are numerous leadership coaches to choose from that work with CEOs and owners. At Fractional Executive Solutions, we offer leadership coaching for your team to ensure smooth delivery of your products or services to your customers as well as enhancing your bottom line. If you are an owner or CEO and you have an incumbent in the role of Manager, Director or even COO, we work with them exclusively to learn how to be a “pro,” while becoming a trusted advisor to you. We provide a structured and documented program that is created with your guidance and input to create goals, and skill sets to improve overall executive and leadership performance. Regular feedback is provided to you so you can see the development of your team as they start to leverage their newfound skills and help your your business thrive.

Emerging Leadership

There are numerous leadership coaches to choose from who work with CEOs and owners. At Fractional Executive Solutions, we offer Emerging Leadership Coaching for those who are about to embark on their first role as a manager or leader. For many, the first leadership role is hard because they must learn to be accountable for the performance of others as well as themselves while learning how to provide direction and guidance to a team. From learning how to manage through time constraints, difficult and often new challenges, or conducting “difficult” conversations, we help them learn the skills required to lead, manage, and hold others accountable. All in a structured process that includes a lesson plan and homework. Your new leader will appreciate the knowledge and the opportunity that they are provided to get a “head start” on their management career.

WHO I REPRESENT

WHAT CLIENTS SAY

EXPERTISE

Modeling SG&A to Drive Towards EBITDA Goals

How do you know what the RIGHT balance is for SG&A?

As a Fractional COO, why would you want to answer a question like that? Would that not be for the CFO to understand? Yes, but as the COO plays a large role in helping understand what level of cost the business can manage while still servicing clients and customers as well as attaining the optimal EBITDA for the year. Several models can be created to understand the right amount of SG&A (Selling, General, and Administrative) expenses for a business. Here are some of the most common and effective approaches:

1. Historical Analysis and Trend Forecasting:

• Method: Analyze past SG&A expenses as a percentage of revenue over several periods (e.g., 3-5 years). Identify trends (increasing, decreasing, or stable) and use these trends to forecast future SG&A needs.

• Pros: Simple to implement, provides a baseline for comparison. Helpful in a steady state business and market.

• Cons: Assumes past performance is indicative of future results and doesn't account for changes in business strategy or market conditions.

2. Industry Benchmarking:

• Method: Compare the company's SG&A-to-revenue ratio with industry averages or competitors. This helps determine if the company is spending excessively or efficiently relative to its peers.

• Pros: Provides external validation, highlights areas for potential improvement.

• Cons: Industry averages may not be perfectly applicable due to differences in business models, size, or geographic location.

3. Zero-Based Budgeting:

• Method: Start from scratch each budget period and justify every SG&A expense based on its necessity and contribution to business goals.

• Pros: Encourages cost consciousness and eliminates unnecessary spending. This is a great model where fiscal discipline is lacking.

• Cons: Time-consuming, requires a detailed analysis of all activities. Battle is that the staff may not understand the importance of “adjusting” headcount to this model.

4. Activity-Based Costing (ABC):

• Method: Identify the activities that drive SG&A costs (e.g., customer service, marketing campaigns) and allocate costs accordingly. This provides a more accurate understanding of the cost of each activity and helps identify areas for efficiency gains.

• Pros: Provides detailed insights into cost drivers and supports better decision-making.

• Cons: Complex to implement, requires accurate data collection. Requires discipline and data that can be easily found and explained.

5. Regression Analysis:

• Method: Use statistical techniques to identify the relationship between SG&A expenses and various business drivers (e.g., revenue, number of employees, customer growth). This helps predict SG&A needs based on changes in these drivers. “Flow-through” or “Drop-through” ratios are established.

• Pros: Provides a quantitative and data-driven approach, can reveal hidden cost drivers.

• Cons: Requires statistical expertise and reliable data, may not capture all relevant factors.

6. Cost-Benefit Analysis:

• Method: Evaluate each SG&A expense based on its expected benefits (e.g., increased sales, improved customer satisfaction) and compare them to the costs. This helps prioritize spending and allocate resources effectively.

• Pros: Focuses on value creation, and ensures resources are used efficiently.

• Cons: Can be challenging to quantify certain benefits and requires subjective judgment.

Important Considerations:

• Business Strategy: The right amount of SG&A depends on the company's strategic goals. A growth-focused company may invest more in sales and marketing, while a cost-conscious company may prioritize efficiency.

• Business Lifecycle: SG&A needs may vary depending on the stage of the business. Startups may have higher SG&A costs relative to revenue due to investments in infrastructure and marketing, while mature companies may have lower ratios.

• Qualitative Factors: In addition to quantitative models, consider qualitative factors such as organizational culture, risk tolerance, and management philosophy.

By using a combination of these models and considering the specific circumstances of the business, companies can develop a more comprehensive understanding of their SG&A needs and optimize spending for maximum efficiency and profitability.

GET IN TOUCH

Savannah, GA 31405 | (682) 514-9073

© 2026 Fractional Executive Solutions | All Rights Reserved